Automation: What you don’t know can hurt you

The FIMA Europe Research Report provides a unique insight into prevailing attitudes to data management among senior financial executives charged with delivering it within their enterprises. These senior executives are personally liable for their areas of responsibility and could face fines or even imprisonment in the event of major failings at their organisations.

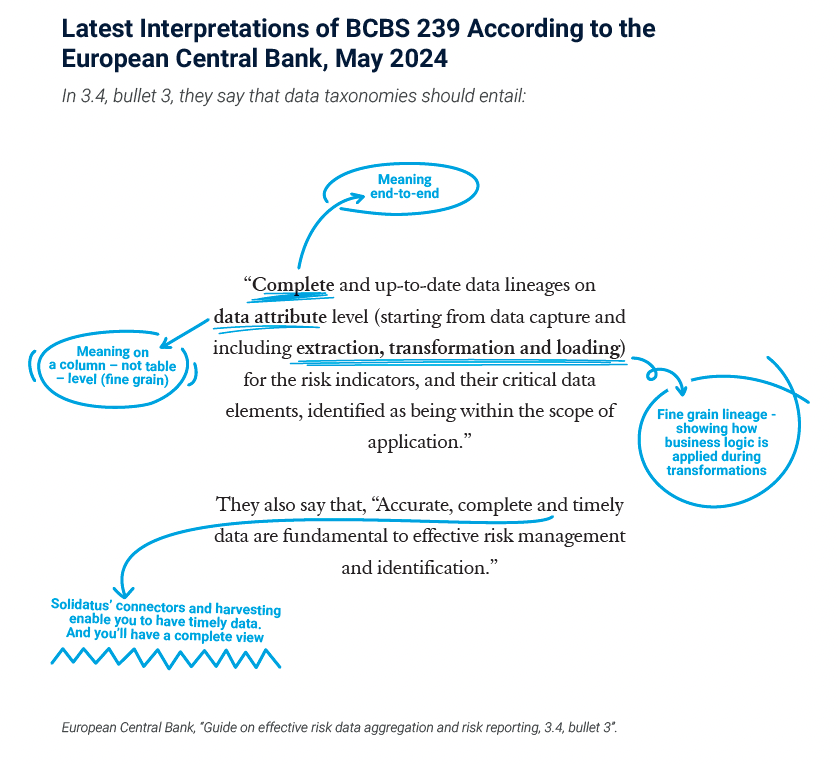

Risk data aggregation standards have been set globally through BCBS 239, and any bank that asserts itself “BCBS 239 compliant” can no longer claim that it was unaware of a dangerous accumulation of risk, or that it could not have acted sufficiently quickly to offset risks, even in periods of extreme market stress. Various regulators of major financial jurisdictions have addressed the matter of personal accountability: the UK with the Senior Managers and Certification Regime (SMCR), Ireland with the Senior Executive Accountability Regime, and within the EU these responsibilities are covered variously by, among others, CRD IV, MiFID II and the EBA/ESMA Suitability Guidelines.

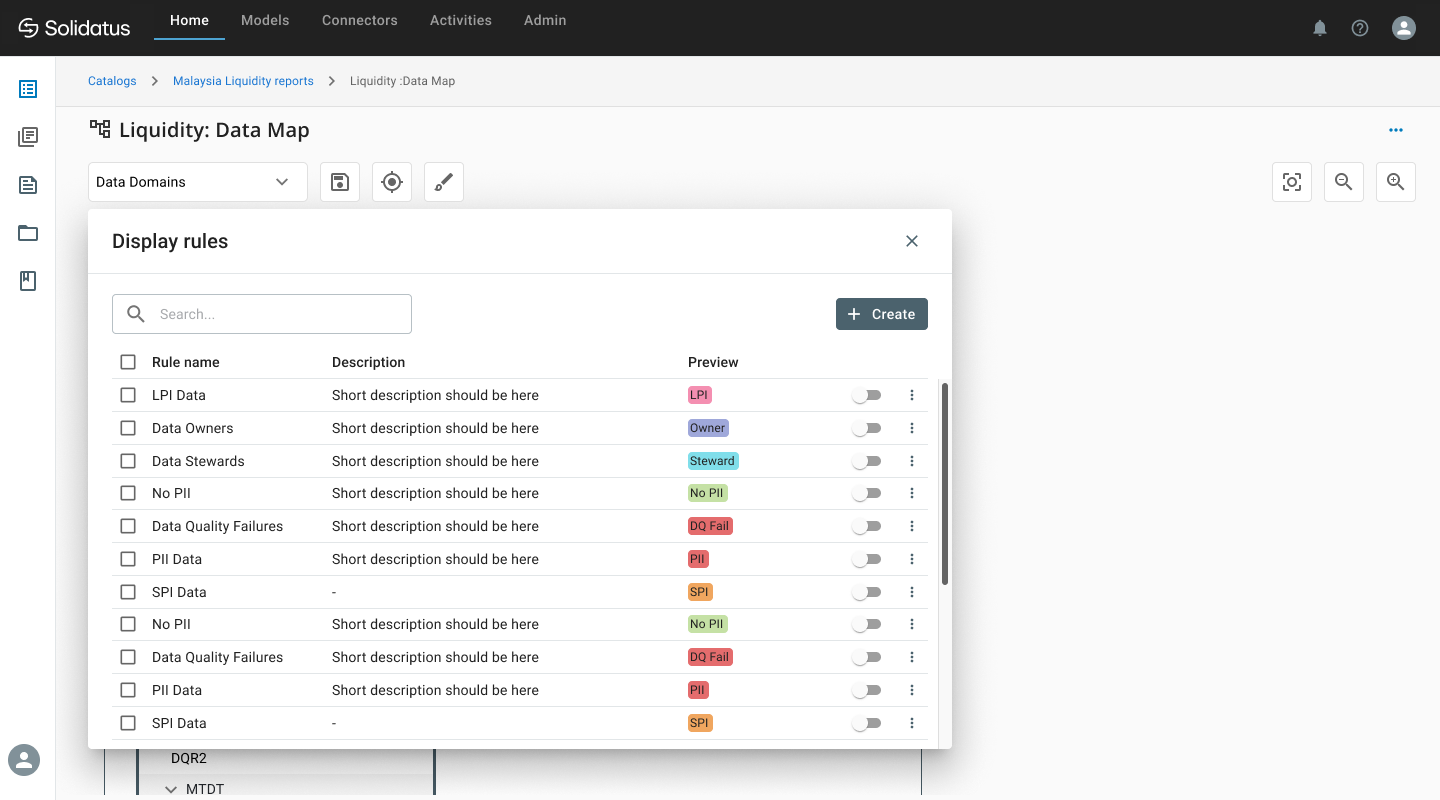

With so much personally at stake, one would assume the respondents to the FIMA report would be expected to ensure that the data for which they are responsible is fit for purpose. Answers to some of the questions, however, suggest that there may still be shortcomings in how organisations are approaching this issue. For example, in response to the question “How do you understand your data in context to anticipate and predict potential risk?” 40% of respondents gave answers that relied on automation or the use of algorithms but only around 10% could provide any description of the processes that they employed – none of the answers addressed the contextual aspect of the question. Just as in grade 8 algebra where only 50% of the marks are allocated to the answer, providing the answer alone is no longer acceptable. Regulators are now demanding that organisations show their workings to prove compliance.

Similarly, in reply to the question “What is your greatest challenge to access the right data and insights to improve customer experience?” 40% replied “I don’t know where to go to for this information.” Answers like these reveal that there is a significant proportion of senior data management professionals who, while aware that the systems for whose data they are ultimately responsible are automated, are not being provided with the necessary information to understand how or where that data is stored. Without that comprehensive understanding of their data landscape, proving that automation is indeed delivering what is supposed to achieve, or in the manner it is believed to be working, is difficult to accomplish convincingly. In addition, planning the most cost-effective upgrade path, or determining how to approach migration to the cloud, or the consequences of decommissioning aging and unreliable systems, becomes unnecessarily costly, difficult, and burdened with risk.

Built by practitioners with a deep understanding of modern data challenges, Solidatus enables organisations to achieve automation with unprecedented levels of reliability, because it is built upon a solid foundation of organisation-wide understanding. With a ground-breaking lineage-first approach, Solidatus provides comprehension and consistency across entire organisations – allowing them to optimise, govern, regulate and achieve transformation with total confidence.

We witnessed the fallout from inadequate data management with the global financial crisis of 2007-2008, when the consequences of banks’ actions could not be seen clearly by the banks themselves until it was too late. The tools they used for data management were not up to the challenge of informing decision-makers adequately: today, Solidatus can provide levels of insight that enable risk to be managed proactively and in real-time. The only effective protection against another financial crisis is a complete understanding of the data, visualised and made available to the right people at the right time. It would be a double catastrophe were another crisis to occur, that could have been avoided had levels of data management across the industry been optimised, rather than succumbing to the false security of poorly-comprehended automation.

Request a demo

Request a demo to see how you can bring simplification to your challenges around metadata management, data governance, and demonstrating regulatory compliance.