ESG Data and Compliance Solutions

The Environmental, Social and Governance (ESG) landscape is evolving, with the emergence of a more complete set of principles, ethics, and ESG reporting standards. With so many standards, disclosures, and rating methods, alongside new data sources required, ESG initiatives cut across a company and require high-level control combined with an understanding of how ESG data requirements intersect.

Delivering a Sustainable Solution for ESG Data Management

Meeting the requirements of ESG compliance marks a commitment to building a more sustainable organization and ultimately a climate-positive company. This leads to more investment and a competitive edge in a world where heavy penalties will be placed on businesses that do not meet rigorous ecological impact assessments.

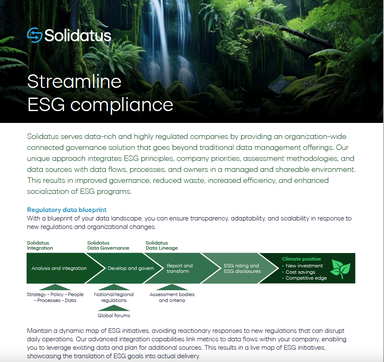

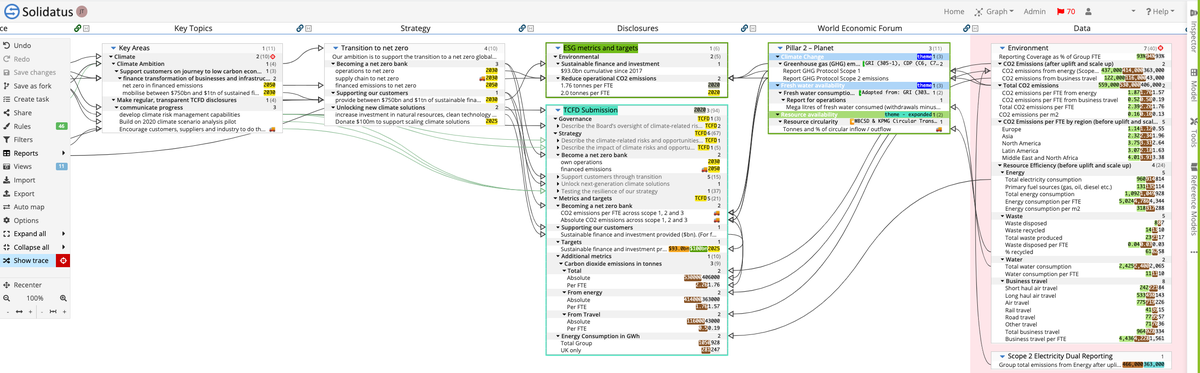

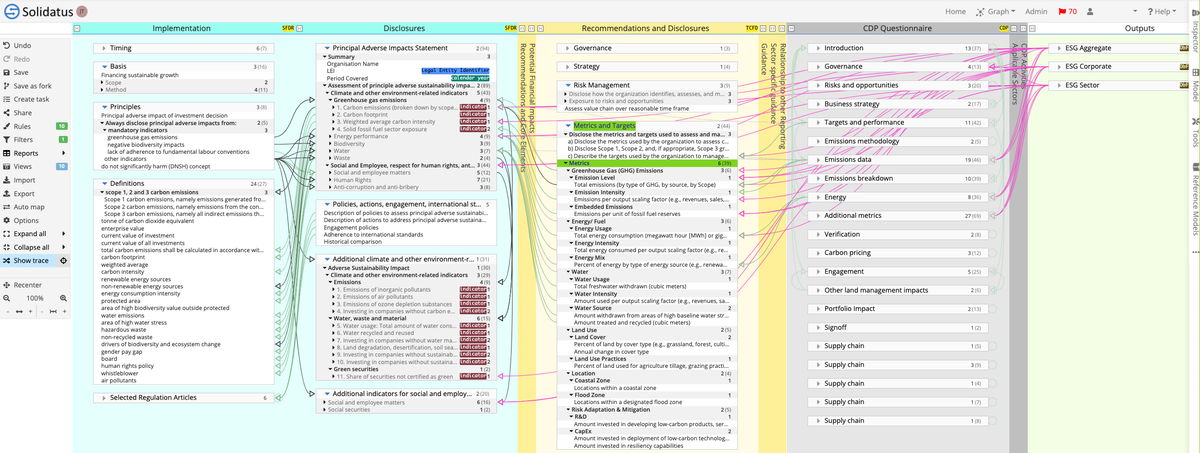

Solidatus’ ground-breaking lineage-first approach brings together ESG principles, company priorities, assessment methodologies, and data sources and metrics to give a full end-to-end picture of the impact of ESG management initiatives.

Practical Data Strategies for Meeting ESG Compliance Obligations in Financial Services

In this ESG whitepaper, we explore best practices for developing an internal framework to identify people and teams responsible for meeting ESG obligations; interpretation of rules and regulations to define the obligation; and defining the deliverables to meet the obligation. This is why ESG is important for companies to consider.

As of March 2021, the Sustainable Finance Disclosure Regulation (SFDR) requires mandatory Environmental, Social, and Governance (ESG) disclosure obligations for asset managers and other financial markets participants (FMPs) for the first time. This means that companies must be ESG compliant in their reporting.

Our sophisticated integration capabilities are used to relate metrics to data flows through the company, both to understand where existing data can be used and to identify and plan for additional sources.

The result is a live map of ESG initiatives, showing how ESG aims translate through to delivery providing assessment bodies with every piece of the puzzle.

Why choose Solidatus for your ESG management?

Instantly Show ESG Compliance with Solidatus

Quickly assess compliance against requirements and standards and demonstrate your company’s adherence to ethical practices with Solidatus’ ESG analytics.

Contextualize ESG Initiatives with Solidatus Analytics

Design, view, and track ESG initiatives across a broad spectrum of markers and to the supporting metrics and new data source requirements. Solidatus’ ESG database capabilities make this process seamless.

Establish Organization-wide Understanding of ESG Reporting Standards

Owners of parts of the data landscape can contribute collaboratively, with all changes versioned for full change management and comparison.

Efficiently Respond to a Changing ESG Landscape with Solidatus

Maintain a dynamic map of ESG initiatives that prevent a panicked response to new regulatory demands that can disrupt day-to-day business.

ESG News and Views from Solidatus

With each passing month, the pace at which environmental, social and governance (ESG) principles are being addressed has been accelerating. Stay up to date as our experts share their advice in the media.

Solidatus Creates, Manages, and Demonstrates Your Complete ESG Strategy

Powerful Query and Visualization for ESG Data with Solidatus

Provide focused views for different stakeholders, highlighting problems such as missing data and duplicate sources. Demonstrate processes and flows from system to field level.

Flexible and Scalable Metadata for ESG Database Management with Solidatus

With Solidatus’ flexible and open metadata model, create hierarchies of regulations and policies, assessment methods and metrics, and add relationships between them and the people and programs that will be delivering them.

Enterprise-scale Modeling and Visualization for ESG Data with Solidatus

The ability to model complete flows is critical to compliance. Share read-only views to engage investors, senior management and regulators.

Deliver Business Intelligence with Solidatus ESG Analytics

Solidatus’ reference model capability integrates business knowledge with technical metadata across flows. Categorize and identify the right data for ESG assessments, ensure completeness and view lineage to the source.

Integrate and Import Diverse Metadata Sources for ESG Compliance with Solidatus

Automate and productionize metadata load with connectors to data and ETL platforms. Update data quality statistics with data quality engine integrations – all supported by change management.

Explore the power of data lineage

Explore the power of data lineage with a free Solidatus trial

ESG stands for Environmental, Social, and Governance. These three broad categories measure the sustainability and societal impact of an organization. They are important factors for investors, stakeholders, and consumers when evaluating a company’s practices and performance.

ESG data refers to the specific metrics that organizations use to quantify their performance in the Environmental, Social, and Governance areas. This can include data on carbon emissions, labor practices, board diversity, and more. ESG data management involves gathering, analyzing, and reporting on these metrics.

ESG is important because it allows companies to demonstrate their commitment to sustainable and ethical practices. It also helps investors and stakeholders assess potential risks and opportunities. Being ESG compliant can improve a company’s reputation, attract investment, and drive long-term growth.

ESG reporting standards are guidelines that help organizations report on their ESG performance in a consistent and transparent way. These standards can vary, but they generally include reporting on environmental impact, social responsibility, and governance practices. There are several different reporting frameworks, standards, and ratings that organizations can use to report their ESG performance. Some of the key ESG reporting frameworks and standards include the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the Task Force on Climate-related Financial Disclosures (TCFD). These frameworks and standards provide principles-based guidance on how information is structured, how it is prepared, and what broad topics are covered. They facilitate the disclosure of comparable, consistent, and reliable sustainability-related information. Recently, there have been several significant changes in the ESG reporting landscape. In 2021, the International Sustainability Standards Board (ISSB) was announced at the COP26 climate conference by the International Financial Reporting Standards (IFRS) Foundation. The ISSB is expected to set sustainability disclosure standards that are shareholder-focused and industry-specific. The new international standards will build upon existing ESG standards and frameworks.

ESG compliance refers to a company’s adherence to established ESG standards and regulations. Compliance can be demonstrated through transparent reporting and disclosure of ESG practices and performance.

ESG management involves strategizing, implementing, and tracking an organization’s ESG initiatives. This includes data collection, analysis, and reporting, as well as aligning ESG goals with broader business objectives.

ESG analytics involve interpreting ESG data to evaluate a company’s ESG performance, identify areas of risk and opportunity, and guide decision-making. Good analytics are key for effective ESG management.

ESG data management involves collecting, verifying, and reporting ESG data. It requires systems and processes for maintaining a reliable and up-to-date ESG database that can be used for analytics, reporting, and decision-making.

An ESG database is a system or platform that stores a company’s ESG data. This database can be used to track performance, generate reports, conduct analytics, and provide transparency for stakeholders.

Solidatus provides a comprehensive solution for ESG compliance, data management, and reporting. With our innovative tools and approach, we help organizations streamline their ESG practices, efficiently manage their ESG database, and effectively meet ESG reporting standards. Our ground-breaking ESG analytics help companies understand their ESG performance and drive sustainable growth.