Combining software to ensure your regulatory compliance

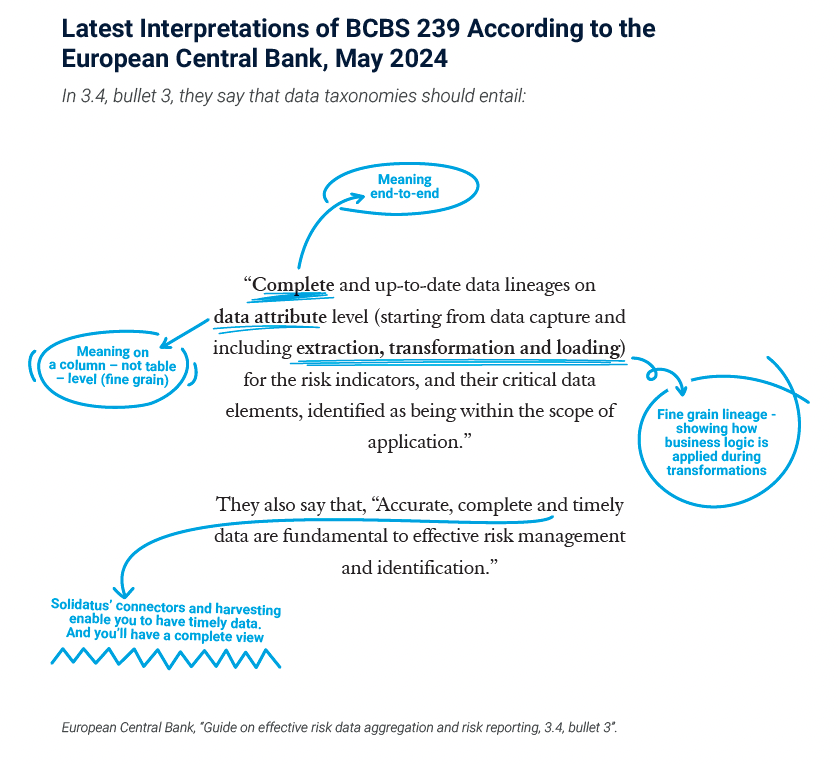

The regulatory landscape for financial firms is complex and subject to increasingly faster rates of change. This can be seen in the graphic below, which shows the ESG disclosure landscape for banks and capital markets in Europe – and this is just part of the regulatory burdens falling on firms.

In addition to meeting each reporting requirement in these regulations, companies also need to demonstrate that they:

- Understand the requirements of the regulations;

- Understand and have control over their regulatory submissions;

- Use reliable and comprehensive data; and

- Report consistently and reliably across their business and reporting submissions.

Source AFME, ‘ESG Disclosure Landscape for Banks and Capital Markets in Europe’, Page 11 (PDF)

In problem-solving, it’s said that two heads are better than one, and the same is often true of the technology that simplifies our lives. We at Solidatus are big believers in the value that partnerships bring to our shared clients. And so it is with keeping track of regulatory changes, how they affect your data and systems, and what decisions and actions you need to take in relation to them.

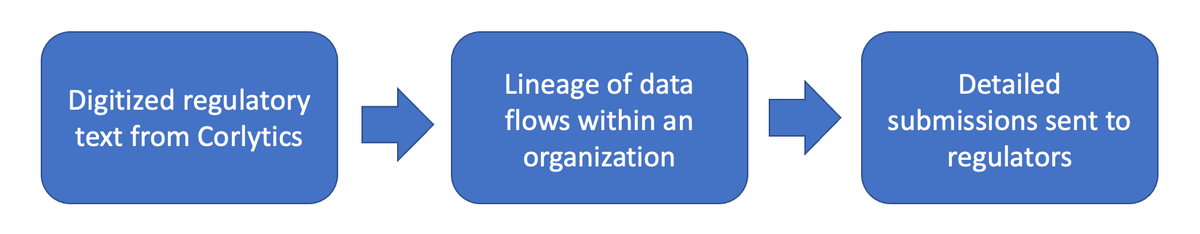

In that vein, today Solidatus announced a partnership with Corlytics to provide customers with a unique and essential tool that allows firms to:

- Understand the changes in regulations in detail, quickly and easily; and

- Demonstrate they are in full compliance with their detailed requirements.

Corlytics is the world’s leading provider of regulatory risk intelligence to enable organizations to take a data-driven approach to regulatory resource allocation. As part of this, Corlytics provides a regulation and law library that stores regulatory content as a fully digital set of obligations in a single location. Corlytics also ensures these digitized regulations are up to date.

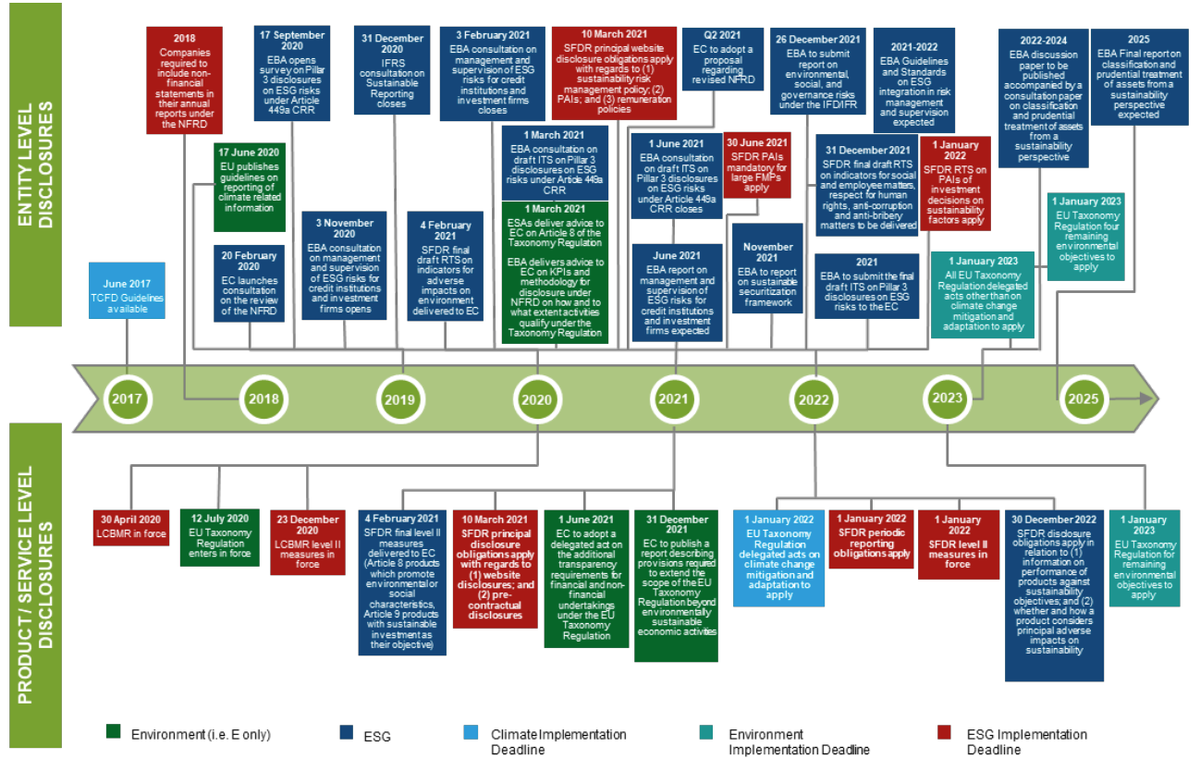

Combining the Corlytics digitized regulations service with the visualization and lineage capability of Solidatus gives clients the unique ability to have a visual, easy-to-use view of regulations that’s focused and shared across the organization.

What does this mean for clients?

Clients can use the combined power of Corlytics and Solidatus to:

- Identify the impact of regulatory change; and

- Demonstrate full compliance with regulations – ‘front-to-back compliance’.

In conclusion to this short blog post, we’ll take a look at what improvements in these two areas mean for practitioners engaged in being compliant and demonstrating this compliance.

Regulatory impact assessment

Using this web-based visualization, the drill-down and workflow capabilities of Solidatus mean firms can review up-to-date regulations and regulation changes, and:

- Share the latest versions and understanding across the firm based on the business area and need;

- Focus in on changes in the regulatory texts to highlight impacts; and

- Reduce the dependency on key regulatory compliance experts.

Sharing specific views of regulatory changes will also help front-office staff understand the impact of changes and facilitate front-office business to take advantage of business opportunities that arrive ahead of competitors.

Front-to-back compliance

Combining the added value of Corlytics content with lineage models across the IT infrastructure of the firm gives firms the unique ability to map their complete compliance with regulations by:

- Mapping regulatory texts from Corlytics;

- Aligning them to the lineage across all bank systems in scope; and

- Linking them to their detailed submissions.

In addition, firms can use this understanding to start to standardize and reuse compliance assets to improve the consistency and efficiency of their reporting across regulations and regulators.

These two use cases highlight the unique value of combining the digitized context from Corlytics with the visualization and lineage within Solidatus, and we look forward to developing further valued services with Corlytics going forward.

Authored by the Solidatus team: simply the best data lineage.