Basel III – Are You Prepared?

Reforms target the recalculation of risk-weighted assets and limiting banks’ use of internal models for risk estimation in setting minimum capital requirements.

Systemically important banks face heightened stress testing and risk data requirements, while expanded reporting rules and risk assessments present new challenges for regional players.

Banks must interpret the rules, assess their impact, and address emerging data and technology requirements by July 2025.

Basel III: What’s Changing

The 2017 ‘endgame’ (B3E) enhances capital calculation by modifying Basel’s approach according to activity risks. Banks have until July 2025 for UK and US to interpret the new rules, during which time they must address emerging data and technology requirements and adapt their business models.

Changes Include:

- Discontinuation of internal risk models for lending activities

- Fresh requirements for assessing market and trading risks, requiring banks to establish new processes and controls for data sourcing, calculations and reporting

- Replacement of internal models for operational risk with standardized approaches considering a bank’s activities and past losses

Being Basel III Compliant: The Challenge

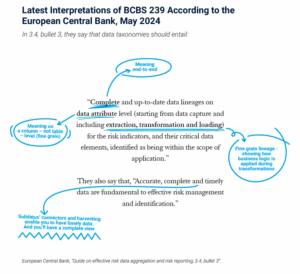

B3E requires significant data architecture upgrades for flexible, auditable, and integrated risk quantification in line with regulatory guidance.

Financial institutions must attain high-quality data on capital, loan books, and portfolios but will struggle for the following key reasons:

- Manual data processing is prone to errors, consuming valuable time

- New data attributes are either not available or require substantial effort to source

- Complex processes, data silos, and limited visibility impede collaboration

- Non-standardized integrations create inefficiencies and complicate data management

- Expanding data volumes put legacy systems under pressure when scaling

Meet Basel III “Endgame” and Achieve Compliance with one Scalable Solution

Solidatus enables banks to meet Basel III simply, and efficiently.

By combining technical data lineage with business context we connect your data to the processes that create it, to the policies that guide it, and to the obligations that regulate it. The result is a ‘live’ enterprise data blueprint that clearly illustrates the impact of Basel III on every layer of your organization.

Build an Enterprise Data Blueprint

- With Solidatus’ powerful connectors, unify your enterprise metadata into a single, manageable view, regardless of how data enters, moves, or is stored in your business.

- Enrich these flows by incorporating business context, ownership and accountability – bridging the business-technical divide.

- Zero in on regulatory obligations, visualizing connections between reporting requirements and underlying data assets.

Interrogate an Evergreen, Single Source of Truth

- Create a compliance roadmap using current, historical, and future data views to quickly evaluate the impact of changes on systems, policies, processes, and personnel, reducing assessment time from months to seconds

- Apply governance principles like ownership, stewardship, and controls, addressing any gaps within the data supply chain

- Discover the root cause of questionable data by tracing its lineage back to its original source.

Automate Reporting and Bake in Compliance by Design

- Federate execution, expediting implementation and lowering program costs

Embed controls across workflows, data, and reports - Automate the generation of regulatory reports, disclosures and submission documents reducing manual effort and resource costs involved in preparing for examinations.

- Provide total transparency for executive decisionmakers, board members and regulators, showing that critical data and underlying sources are well-known and controlled.

Watch how Solidatus tackles Basel III head-on