Solidatus secures £5 million backing from Salica Investments

Regulatory Compliance

Regulatory Compliance

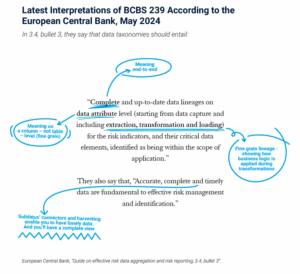

The ECB is “Intensifying its Supervisory Approach” on BCBS239 Compliance – and Basic Lineage is Not Sufficient

Navigate BCBS 239’s rigorous standards with advanced data lineage

Providing Accurate, Complete and Timely Data for BCBS239 Compliance

Discover how to stay ahead in the evolving regulatory landscape of BCBS239

On Demand

Pioneering Data Strategies: How Bank of New York is Shaping Business Success in the Age of AI

Find out about the role of AI and advanced data lineage as AI reshapes the future of business

Unveiling the Path: Why Data Lineage is Crucial for Building Effective AI Products

Read more about data lineage and its business impact, including on AI, BCBS 239 and more

Change Management

Change Management

Moving to and Within the Cloud

Download this whitepaper for essential advice and guidance on moving to the cloud and succeeding once you’re there. Plus, we discuss regulatory considerations, how to get started, and include a handy pre-migration checklist.

Asset Management Firm Transforms Investment Environment

An asset management firm used Solidatus to carry out a multiyear digital transformation project

Data Governance

Data Governance

NOW: Pensions Achieve Transparency using Solidatus as Central Data Governance Tool

Mapping and modelling a data estate - and showing which data is subject to GDPR

Advanced Data Lineage: A Blueprint for Business Success

Understand the business impact of basic data lineage vs modern, advanced data lineage

Data Products

Data Products

On Demand

Building Data Trust in LSEG

Hear how Solidatus supports the LSEG Data & Analytics Data Trust Programme

On Demand

Pioneering Data Strategies: How Bank of New York is Shaping Business Success in the Age of AI

Find out about the role of AI and advanced data lineage as AI reshapes the future of business

Decision Making and Reporting

Decision Making and Reporting

How Data Lineage Helps our Customers Trust the Data Used in Reports and Strategic Decisions

How data lineage supports Solidatus customers with reporting and decision making

Advanced Data Lineage: A Blueprint for Business Success

Understand the business impact of basic data lineage vs modern, advanced data lineage

Operational Resilience

Operational Resilience Data Lineage

Data Lineage

Solidatus Chosen as Microsoft Purview’s Data Lineage Integration Partner

Microsoft names Solidatus as key technology partner in their reimagined data governance experience with Microsoft Purview.

Advanced Data Lineage: A Blueprint for Business Success

Understand the business impact of basic data lineage vs modern, advanced data lineage

Integrations and Solutions

Integrations and Solutions

Solidatus Chosen as Microsoft Purview’s Data Lineage Integration Partner

Microsoft names Solidatus as key technology partner in their reimagined data governance experience with Microsoft Purview.

Solidatus is a proud participant in the Microsoft Security Store Partner Ecosystem

Solidatus, a leading provider of data lineage solutions, today announced its inclusion in the Microsoft Security Store Partner Ecosystem.

Agentic AI

Agentic AI

On Demand

Pioneering Data Strategies: How Bank of New York is Shaping Business Success in the Age of AI

Find out about the role of AI and advanced data lineage as AI reshapes the future of business

Advanced Data Lineage: A Blueprint for Business Success

Understand the business impact of basic data lineage vs modern, advanced data lineage

Past Event

DataVision Americas 2025

Join us in New York City (or virtually) on December 9th to hear from industry experts and practitioners and network with your peers as we explore critical data management and advanced analytics topics. DataVision 2025 is COMPLIMENTARY for members, prospective members, guests and all data management professionals.

Why Truth Beats Hope in Banking

Most AI failures don’t come from the model—they come from the data feeding it.

What is Data Lineage?

What is Data Lineage? Blog

Blog

The 48-Hour Test: Does Your AI Have Complete Data Lineage?

Three institutions receive the same question during Model Risk Management reviews: “Walk us through the complete data lineage for your credit decisioning models.

How data lineage prevents AI failures in financial services

Solidatus’ Tina Chace and fellow experts reveal why 90% of AI model failures trace back to upstream data changes

Webinars and Events

Webinars and Events

On Demand

Zero To Lineage on Demand

Deliver clarity from chaos - at speed. Data lineage is one of the most critical foundations for governance, compliance, and transformation, but getting started can feel like climbing a mountain.

Past Event

DataVision Americas 2025

Join us in New York City (or virtually) on December 9th to hear from industry experts and practitioners and network with your peers as we explore critical data management and advanced analytics topics. DataVision 2025 is COMPLIMENTARY for members, prospective members, guests and all data management professionals.

Case Studies

Case Studies

Royal London Asset Management (RLAM) Builds Operational Data Blueprint

How RLAM used Solidatus to carry out critical digital transformation initiatives

Transforming HSBC’s Lending Business with Solidatus

HSBC's scalable lineage solution is applied to many uses, from ESG to liquidity calculations and more

Whitepapers

Whitepapers Factsheets

Factsheets Podcasts

Podcasts

The Data Governance Podcast

"Having that complete picture of your data estate is foundational for data governance". In this podcast, Nicola Askham, The Data Governance Coach, speaks with Steve Neat, CRO at Solidatus, about the importance of data lineage for regulatory compliance, AI, and more.

From Months to Minutes: The Benefits of Automated Data Sharing

"Approvals are now sought and gained in minutes, rather than in months". In this podcast, Susan Walsh, Founder and MD of The Classification Guru, speaks with Kate Platonova, Group CDO at HSBC, and Lorraine Waters, CDO at Solidatus, about how HSBC is modernizing data sharing with their DataVisa initiative.

FAQs

FAQs Careers

Careers

Solidatus Announces Strategic Investment from CITI

Solidatus announce a strategic investment from Citi, the leading global bank. Citi is also implementing the Solidatus platform internally, at a global enterprise level.

Alteryx Partnership Helps Demonstrate Connected Governance

Solidatus has enhanced its alliance with Alteryx, helping shared customers visualize data flow across their Alteryx workflows through the Solidatus interface.

Contact

Contact

Ready for Vietnam’s New Data Protection Era?

"Vietnam is poised to pass a new decree that will bring the nation into line with its peers across APAC and internationally when it comes to personal data protection."

A-Team Data Management Insight Awards 2021

We are excited to announce that we have been named as the winners of two categories at the A-Team Data Management Insight Awards 2021.

News

News

How M&T Bank ensures data quality as it implements gen AI

Andrew Foster, the bank's chief data officer, explained how he has been instilling data discipline across the organization and making the bank's data AI-ready.

Tracking data lineage from data archaeology to digital twins

Data management must now grow and evolve a new arm that extends to data lineage control. As data streams flow through IoT machines, users, applications The ability to map and manage living data systems could be set to become an essential part of how enterprises build resilience and maintain trust.

Funding secured to continue driving AI-accelerated data lineage capabilities and expand enterprise data governance solutions

LONDON, UNITED KINGDOM – October 30, 2025 – Solidatus, a leading provider of data lineage solutions, has announced that it has secured a £5 million loan from the Growth Debt Fund at Salica Investments, the UK-based investment firm focused on the most promising UK and European companies, to support research and development and drive continued company growth. The funding will primarily be used to accelerate the development of AI-enabled data lineage capabilities within the Solidatus platform, transforming how users interact with complex data models by combining the power of natural language processing with Solidatus’ deep lineage intelligence.

The global data governance market is projected to grow to almost $20 billion by 2032*, with data lineage becoming an increasingly key component of this. This comes as a result of rapidly expanding data volume and complexity, stricter regulations like the EU AI Act and BCBS 239, and a growing need for data quality and security. As one of the pioneers of advanced data lineage for organisations operating in highly regulated markets like financial services, energy and pharmaceuticals, the Solidatus platform enables businesses to map, manage, and understand exactly where data originates, how it transforms, and where it flows.

The new investment from Salica will support the accelerated development of AI-enabled capabilities within the Solidatus platform. This next stage of innovation will enable the Solidatus platform to automatically generate data lineage with human-in-the-loop verification, reducing the time and manual effort traditionally required for complex data governance tasks. By automating lineage implementation and supporting inter-system lineage, Solidatus will further simplify how organisations build trust in their data and meet regulatory requirements.

Salica Investments, which has a strong heritage supporting high-growth UK and European companies, identified an opportunity to help scale the Solidatus offering at a time when businesses in every industry are demanding optimum clarity into the reliability of their data. Usman Ali, Partner in the Growth Debt Fund at Salica Investments, explains, “Solidatus exemplifies the kind of business we look to back, combining exceptional leadership, a roster of Tier 1 customers, and world-class expertise in data lineage, which is increasingly critical for enterprise data governance and regulatory compliance. We’re delighted to support Solidatus in their growth journey, with this funding helping to accelerate product development and scale their operations.”

The investment brings Solidatus’ total funding to £25 million following a Series A round led by AlbionVC with participation from HSBC and Citibank in 2021. The company has been experiencing strong commercial momentum in recent months, having been added to the Microsoft Security Store Partner Ecosystem and listed on the Microsoft Azure Marketplace, as well as being positioned in Gartner’s first-ever “Data and Analytics Governance Platforms” Magic Quadrant for delivering fine- grain data lineage for large enterprises in highly regulated markets.

“This investment from Salica Investments comes at a pivotal time for Solidatus as we scale to meet the growing demands of data lineage,” said Alun Baker, Executive Chairman at Solidatus. “Our focus on advancing the platform’s AI capabilities will further enhance our customers’ ability to manage complexity, ensure compliance, and unlock the value of trusted data at scale. Without lineage, even the most advanced models risk instability and regulatory cracks will start to show, with major consequences to businesses across all sectors.”

Solidatus empowers the world’s most complex organisations to truly understand and trust their data, ensuring confidence in business decisions, regulatory compliance, digital transformation, and AI initiatives. By visually mapping the entire journey of data, from its origin through multiple systems to its final destination, Solidatus provides organisations with a clear, auditable view of their data’s flow and transformations.

Trusted by leading global institutions such as HSBC, LSEG, Deutsche Bank, Bank of New York, and ABN Amro, Solidatus is redefining how organisations govern and leverage their data. For more information about Solidatus’ offerings on the Microsoft Azure Marketplace and Microsoft Security Store Partner Ecosystem, or to explore how Solidatus can transform your data governance strategy, please contact solidatus@mhpgroup.com or visit www.solidatus.com.

Founded originally as an investment firm focusing on the most promising businesses, Salica has evolved into a unique set of private market funds investing in equity and debt across multiple sectors and stages, predominantly across the UK.

Salica fuses traditional values with a contemporary approach and balance exacting processes with the agility to capture commercial opportunity and compelling investment returns. Our continuous search for new opportunities has led us to create a balanced collection of contemporary funds and relationships.

More details can be found at: http://www.salicainvestments.com

Published on: October 30, 2025

Subscribe for latest news, blogs and resources.